Bankruptcy Attorney Near Me $0 Down

At Gaudiosilaw, we understand that financial hardships can make it difficult to cover even basic expenses, let alone the costs associated with filing for bankruptcy that is why we are proud to offer $0 down bankruptcy.

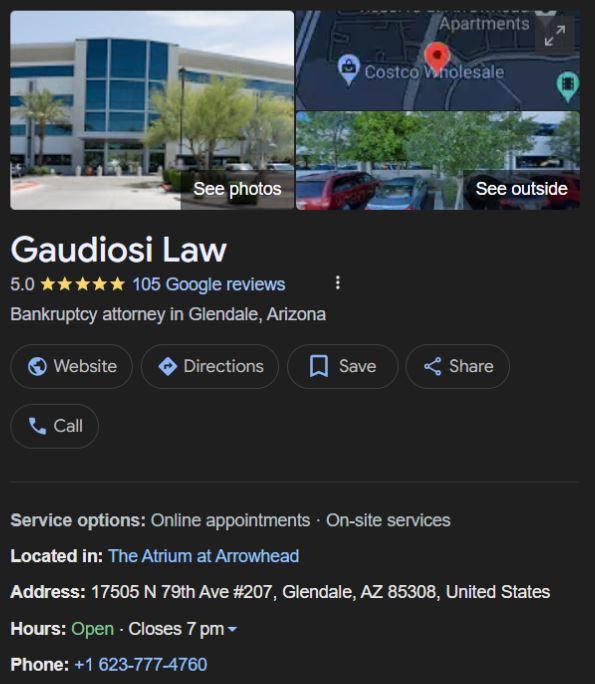

If you’re searching for a no-money-down Chapter 7 near me, Gaudiosilaw can help. To learn whether this option is available to you, please schedule a free consultation by calling (623) 777-4760.

Bankruptcy Attorneys Near Me With Payment Plans: Benefits

We offer flexible payment options for people searching for zero-down bankruptcy lawyers. Navigating the complex process of bankruptcy can be overwhelming, especially when you’re already facing financial difficulties. Hiring a bankruptcy attorney with payment plans can offer numerous benefits, making it easier for you to manage your financial recovery. Here are several reasons why opting for an attorney with flexible payment options can be advantageous:

Immediate Legal Assistance Without Upfront Costs

One of the primary benefits of choosing a bankruptcy attorney with payment plans is that you can access legal assistance immediately, without the need for upfront payments. At Gaudiosilaw, you can hire us for zero dollars down. This affords you the ability to let creditors know that you have hired an attorney for filing for bankruptcy. This is crucial for individuals who need to act quickly to protect their assets or stop creditor harassment but don’t have the funds to pay for legal services right away.

Manageable Financial Burden

Bankruptcy attorneys who offer payment plans understand the financial strain their clients are under. By spreading the cost of legal fees over a period of time, these attorneys make it more manageable for you to afford their services. This can significantly reduce stress and allow you to focus on the steps needed to regain financial stability.

Improved Access to Experienced Legal Representation

Flexible payment plans can open the door to more experienced and reputable bankruptcy attorneys who might otherwise be unaffordable. With the ability to pay over time, you can hire a lawyer with a proven track record, increasing your chances of a successful bankruptcy outcome. Jim Gaudiosi has 5-star reviews on Yelp and Google.

Tailored Payment Plans to Fit Your Budget

Many bankruptcy attorneys offer customized payment plans that take your specific financial situation into account. This means you can work out a payment schedule that fits your budget, ensuring that you don’t fall behind on other essential expenses while paying for legal representation.

0 Down Bankruptcy Near Me: Expert Help at No Upfront Cost

If you just lost your job or are overwhelmed by medical bills or some other financial issue, Jim Gaudiosi is the zero-down bankruptcy lawyer near you. We can file the majority of bankruptcy cases with no upfront payment. We understand that most people filing for bankruptcy can not afford to cover the cost, at least not immediately or at once.

No Money Down Chapter 13 Near Me

Finding a bankruptcy attorney no money down can be a game-changer for those facing financial difficulties. This option allows you to reorganize your debt into a manageable repayment plan without the need for an upfront payment.

By choosing a no-money-down Chapter 13, you can immediately begin the process of debt relief and work towards financial stability, all while retaining essential assets like your home and car. This approach provides a lifeline for individuals seeking a fresh start without the added stress of initial costs. Keep in mind that a chapter 13 case requires all legal fees to be paid upfront. The law does not allow for post-bankruptcy-filing payments to legal counsel as all money is directed to your repayment plan once your case is filed. However, you can hire Gaudiosilaw for no money down. You can make payments towards your upfront legal costs while Gaudiosilaw is preparing your chapter 13 bankruptcy documents and repayment plan. Once you have made your upfront legal payments, Gaudiosilaw will take care of the rest and make sure your case is filed so you can attain bankruptcy protection.

Should I Go With a Lawyer or Document Preparer?

Many people who believe they cannot afford an attorney to help them with filing for bankruptcy will seek out a legal document preparer. While document preparers are useful for many things, a legal document preparer cannot offer you any legal advice. Filing for bankruptcy is a complex task that requires knowledge of very specialized legal training and expertise. Do not risk your assets and financial future to a document preparer. Seek out a qualified bankruptcy lawyer such as Gaudiosilaw to help you file for bankruptcy. With our low payment options and zero down approach, you can afford to know what you are getting yourself into by filing for bankruptcy. The payments are affordable and your bankruptcy will be handled with care at Gaudiosilaw.

Frequently Asked Questions

How Can I Find $0 Down Chapter 7 Near Me?

If you’re searching for zero-down chapter 7 near you, look no further. Gaudiosilaw offers $0 down bankruptcy in Arizona. We have 5-star reviews on Yelp and Google and are dedicated to helping you become free from debt.

What Is Bankruptcy No Money Down?

Bankruptcy No Money Down refers to a legal arrangement where you can begin the bankruptcy process without needing to pay any upfront fees or costs. This option is designed to provide relief for individuals who are in significant financial distress and cannot afford the initial expenses associated with filing for bankruptcy.

Instead of paying all legal fees upfront, you can often arrange to make payments over time, allowing you to start the process of debt relief and restructuring your finances immediately. This approach helps ensure that those in financial hardship can access the legal assistance they need to manage and resolve their debts.

What is a Document Preparer?

A document preparer is akin to a paralegal who has the knowledge of how to prepare a bankruptcy petition for relief under the Bankruptcy Code. However, a document preparer is forbidden from giving anyone legal advice. They can simply enter information into a software that prepares the documents you need to file for bankruptcy. There are many nuances to every bankruptcy case. Many people fall victim to a bankruptcy trustee and lose assets including their home or cars because they do not fully understand bankruptcy law and went into a bankruptcy not knowing how to protect themselves.

Who is a Bankruptcy Trustee?

The bankruptcy trustee is a person hired by the bankruptcy court whose job it is to oversee bankruptcy cases. The trustee is looking for assets which might be sold or liquidated. The trustee will also review certain financial transactions which may be reversed or unwound. Anyone filing for bankruptcy under any chapter will have to deal with a trustee. Trustee’s act in the best interest of your creditors. They try to find money or assets with which they can sell, liquidate or turn into cash to pay creditors. Always seek the advice of a lawyer before dealing with a bankruptcy trustee.