Real Estate Fraud in Arizona

In my law practice, I see many of my clients have been scammed by nefarious individuals. Some of these scams include; Bitcoin or Cryptocurrency scams, credit card scams, love scams, and real estate scams. Scammers are constantly sending text messages, emails, phone calls, and other forms of communication hoping to catch someone who is unsuspecting or naïve.

People who have been defrauded out of their hard-earned money find themselves in a situation where they have lost their money, credit, savings, and sometimes their homes due to falling for these scammers. In many cases, filing for bankruptcy is their last option to save what assets they have remaining from the reach of creditors. In this article, we will take a closer look at real estate scams and how to protect yourself and your home.

What Is Real Estate Fraud?

Real estate fraud can take on many forms whether you are the homeowner or a real estate purchaser, seller, or even a renter. These scams typically involve the fraudulent transfer of title of a person’s home or property by forgery, falsification of documents, ownership records, and other means that might give the allusion that one person owns a property when they do not. The two most common forms of real estate scams include title and deed scams and mortgage loan fraud.

There are other scams involving a person or entity who claims ownership of a property, usually vacant, attempts to rent the property, collects rent or security deposits, and then moves on with the money. The renter attempts to move into the newly rented residence only to be forced out by the true owner.

Home Title Theft / Mortgage Title Theft

Home title theft, also known as mortgage title theft or property title fraud, is a type of real estate fraud in which a scammer gains control over the title of a homeowner’s property without the owner’s knowledge or consent. This type of fraud typically involves the following steps:

Obtaining Personal Information

The fraudster starts by obtaining personal information about the homeowner, such as their name, address, and possibly even their Social Security number.

Falsifying Documents

The scammer then forges documents to transfer the property’s title into their name or a fictitious entity. These documents may include a fraudulent deed or other paperwork related to property ownership.

Recording the Fraudulent Documents

The scammer files these forged documents with the local county or city recorder’s office, making it appear as though they are the legitimate owner of the property.

Taking Out Loans or Selling the Property

Once they have control of the property’s title, the scammer may attempt to take out mortgages or loans using the property as collateral, sell the property to an unsuspecting buyer, or even rent it out. They can profit from the property while the rightful owner remains unaware.

Hidden Ownership

Homeowners are often unaware of the theft until they receive notices of missed mortgage payments, foreclosure proceedings, or even eviction notices.

Home title theft can have devastating consequences for homeowners, including financial losses, damage to credit scores, and the potential loss of their homes. It can be a challenging and time-consuming process to rectify the situation and regain ownership of the property.

What Are Title and Deed Scams?

In Arizona, title and deed scams involve the scammer using trickery and forgery to gain access to a person’s home. The scammer will pose as a real estate agent or investor, gather personal identification information from the true homeowner, then use this information to create a forged title or deed, obtain additional mortgage(s) on the property in the true homeowner’s name while the scammer collects the funds, sell the property out from underneath the true homeowner, attempting to foreclose on the property, or scam the true homeowner into signing over the property deed or title to the scammer.

A lot of times these scams are done to people in mortgage distress. The homeowner is facing a foreclosure proceeding or “trustee sale.” The scammer poses as a real estate “guru” who can help the homeowner out of their jam by transferring title to the scammer.

The scammer promises to help the homeowner catch up on the payments or some other incentive to get the homeowner to transfer ownership of the property. Once the scammer obtains the title or the deed, the scammer can easily obtain fraudulent mortgage(s), sell the property to someone else, sell the property to a “straw man” who then transfers the property to someone else or another entity, or many other scams.

A straw man is a legal term meaning a third party whose sole purpose is to conceal information or who the real identity of someone else is and what their true intent is regarding the property. According to former Arizona Attorney General, Mark Brnovich, between January 2021 and August 2022, more than 65 reports of scams were reported to the authorities.

Frequently asked questions

Is Home Title Lock Legit?

“Is home title theft real?” According to this article published by Resch, Root, Philips, & Graham, LLC, Home Title Lock doesn’t prevent you from being scammed, rather, it checks periodically to see whether your title has been transferred out of your name.

How Do I Protect Myself and My Home?

There are several things you can do. Most recently, the Arizona legislature passed a new law that allows homeowners to sign up with the Maricopa County Recorder to receive alerts whenever someone files any type of information on the Maricopa County Recorder’s system. I highly recommend signing up for this free service.

If you are facing foreclosure, own an empty or vacant property, have a property in probate court, or any property that you feel might be a target for scammers, check the Recorder’s office frequently for your county for any new or suspicious activity. Be wary of people who come to your door offering help.

While most of these people are real estate investors or agents and are offering a legitimate service, be wary of anyone who asks you to sign over title to your home, requests personal identification information, offers to put your home’s title or deed into a “straw man” situation so you can catch up on the payments.

Do your due diligence to anyone claiming to help you. Talk to a lawyer for advice before you sign any contract or agreement that involves transferring the title or the deed to your home to someone else. Contact a real estate agent you trust for help if you have no one else. Make sure that the documents you sign are notarized.

Typically transfer of real property requires a title agent to record the documents. Make sure that a legitimate title agent is being used to transfer ownership. The bottom line is if you are unsure about what you are doing, stop the process before you get too far into it.

What Do I Do if I am a Victim?

Unfortunately, there’s not much the police can do to help you once you become a victim of real estate fraud. There are some things you can do. Contact a lawyer for help. Lawyers are expensive in many cases, but it may be worth it to save your home.

Contact the Arizona Attorney General’s Office and file a complaint. It will be worth it if the authorities are able to catch the culprits. You will also need to file paperwork with your lender alleging fraud. You can’t reverse any recorded documents, so you’ll need to get it on file that there are fraudulent documents in your records.

If you are facing foreclosure or having a hard time keeping up with your expenses, give me a call today. I can help you save your home, eliminate debt by filing bankruptcy, modify your mortgage, and if all else fails, sell your home in a short sale or traditional sale, whichever works best for you.

How Common is Home Title Theft?

Home Title Theft isn’t as common as insurance companies want you to believe. According to the FBI, in 2021, there were 11,578 reported cases of real estate fraud, totaling more than $350 million in damages but these numbers do not only represent Home Title Theft but several kinds of real estate fraud.

What Happens if Someone Steals the Deed to Your House?

If the deed to your home is stolen, you’re at risk of losing your property.

What is the Home Title Lock Cost?

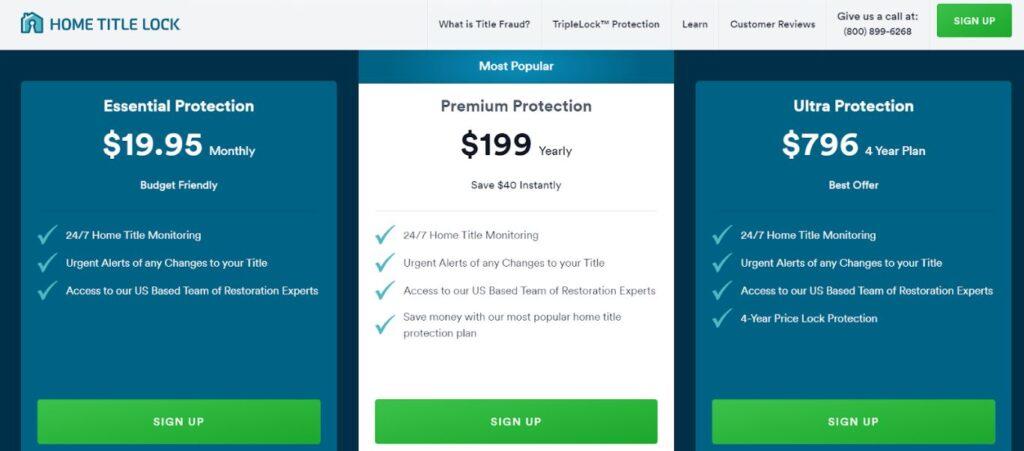

In order to prevent house title fraud, Home Title Lock offers Home Title Lock Coverage Plans starting from $19.95 to $769 for 4 years.